You will learn about cash flow forecasting because I will be showing you the cash flow spreadsheet that is budgeting, planning, forecasting and (most importantly) inspiration all wrapped into one file.

Some of you already understand the importance of cash to any business. And some of you also understand the importance of cash flow as opposed to just cash. The remaining contents of this article is for people who don’t. 🙂

###

Most businesses fail because of lack of available cash; not that the business idea was bad, but because the business was unable to manage their cash. This automatically makes accounting a very important aspect in your business.

Cash is to your business what blood is to your body – it matters how it flows

Accountants make good entrepreneurs. Why? Because they tend to look at the most essential ‘indicator’ of any business’s health; the cash flow.

But I sucked at accounting.

I just could not get into the ‘routine’ of compiling receipts and tracking the money spent. But changing this attitude towards numbers was essential for me.

So here is that ONE tool that has helped me get through the most difficult of financial times, and continues to help me in forecasting for future projects. This tool actually inspires me to plan my cash, which is something I never thought was possible for me!

The Cash Flow Sheet

Some of you may find this too basic, too simple. Excellent! Because that is exactly why you are not doing this often.

What you need to do is:

- Identify how much money you have right now (starting capital/available cash/money-in-hand etc)

- Identify how much expenses are you going to incur per month

- Identify how much revenue can you generate per month

So you start with these. Then you fire up your trusted spreadsheet software (Excel for many of you; I use OpenOffice Calc program – because the non-pirated Microsoft Excel software is just too damn expensive, and OpenOffice suite is free!).

Basic Assumptions in your Cash Flow

To keep this interesting, let’s pick a real-life example of a Cake Baking business. To keep this simple, let’s make a few assumptions.

- You will start with 50,000 rupees.

- You will be selling only cakes (although you can – and should – sell other baked items)

- You already have established how you are going to reach your target market. This post is not about how to set up a cake baking business, but this post is about how to manage the cash in a fictitious cake baking business.

So in our example, here are the assumptions that will help us in our cash flow forecasting:

Three important things here:

- These are ‘dynamic’ values. The power of spreadsheets is that you can start with one value, and then use that value to build upon and test. For example, the cost per cake can be calculated and typed in, and from there, you will use the spreadsheet formulas to calculate gross profit per pound. You should try to have the least number of typed-in values, and use formulas within the spreadsheet to calculate other values.

- This is a cake business, so we are talking about costing to the last pound. You, as an entrepreneur, will work out the cost per basic unit in your business (in a dairy farm, for example, you’d calculate cost to the last liter etc).

- Your Assumptions are your targets and your budgets. If I have typed-in ’15’ as the number of cakes sold in a month, then that is my target. If I have typed in ‘1000’ PKR (Pakistani Rupee) as the cost of a 4 pound cake, then that’s a budget.

Now that we have the basic assumptions within our cash flow, let us now see how these assumptions pan out over an extended period of time (meaning, will you be making money with these assumptions?)

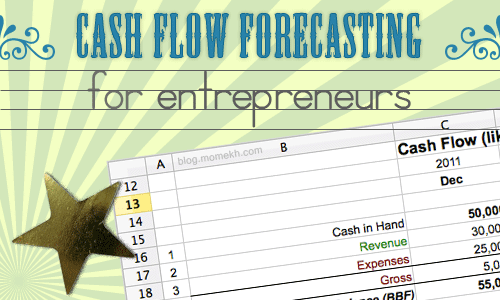

Laying out the first month

Let’s see how these assumptions are spread out for our first month.

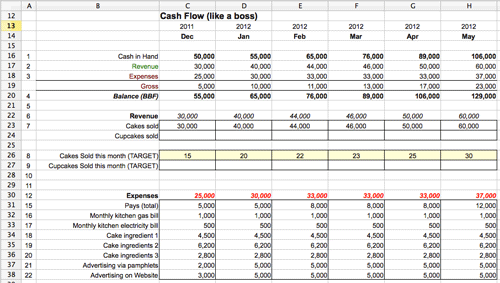

As you can see, there are three sections/blocks of information here.

As you can see, there are three sections/blocks of information here.

- The first is the summary, to immediately see the health of your business. Remember, cash is one of the best indicators of your business health (cash is to your business what blood is to your body – it matters as long as it flows).

- The details of the Revenue. You are selling only cakes, so this is a one-liner in this case.

- The details of the Expenses. Total expenses are 25,000, with product cost accounting for 60% of the total expenses within that month.

Ideally, you will put in enough details into the expense section to see the exact cost of goods.

For example, you can easily make the expenses section like this:

The total expense is the same (25,000), but now you have more details, to tweak and test.

The total expense is the same (25,000), but now you have more details, to tweak and test.

This way, you will be able to see which expense can be cut down by how much and how that would affect the whole business. This information is very, very valuable.

Now, you should be able to add in some basic formulas to the spreadsheet. If you do not know how to do that, no need to worry. You can very easily learn that (and I highly recommend that you learn some basic spreadsheet editing).

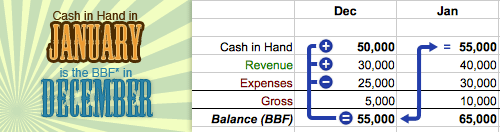

An important equation in this spreadsheet is carrying forward your BBF (which is Balance Brought Forward) to the next month.

Now we put all of this together.

Now we put all of this together.

The Final Piece

It’s time to justify the term ‘forecasting’ in the phrase cash flow forecasting. Let’s plan for the next six months.

As you can see in the above image, the cash flow spreadsheet has been tweaked further.

For example, there is a “Cakes Sold per month” row (with the yellow background).

The fun in all of this is that you can easily see how much money you will be making by selling 5 more cakes than targeted.

That is the power of spreadsheets and it should be used not only for forecasting, but for inspiration!

How I use Cash Flow Forecasting

To take full advantage of your cash flow forecasting, try to make all valuables derivates from the assumptions (as discussed above). This way, you just change the assumptions, and the cash flows six month down the line adjust automatically.

In my dairy farming enterprise, I have worked very hard to make the cash flow assumptions as accurate and as detailed as possible. The cash flow assumptions are done on a separate spreadsheet, and the forecasting (the monthly breakdown) is completely derived from the assumptions. And that cash flow statement stretches not up to 6 months, but up to 3 years. Yes, three years! So if I change the cost of fodder by adjusting for higher yields, I can see the cash affects all across the enterprise. Just simply remarkable!

Cash flow forecasting is very important to your business. I repeat, most businesses fail because of mismanagement of cash and nothing else. And the best way to guard against such errors in judgement is to have an updated cash flow forecast.

###

Did you find the above information useful?

I know a lot of you probably have more elegant solutions to cash management than this one. Do you think this can be improved? Any ideas, suggestions etc, do share it in the comments section below.

And if you did find it useful (or know someone who may find this useful), then please do share this with your friends on Facebook and/or Twitter etc.

If you haven’t already, you can subscribe to this blog via email to receive free updates on articles on creative self employment.

And as always, do not hesitate to ask any questions regarding how to do this. Good luck.